ernestinethomp

About ernestinethomp

The Rising Reputation of IRA Gold: A Safe Investment for the Long Run

In recent years, the idea of investing in gold by Particular person Retirement Accounts (IRAs) has gained significant traction among traders in search of a secure haven amidst financial uncertainty. With fluctuating markets, rising inflation, and geopolitical tensions, many are turning to gold as a dependable asset that may protect their wealth and guarantee financial security in retirement.

Gold has been a symbol of wealth and a store of worth for centuries. Not like paper currency, gold has intrinsic value, which makes it a fascinating investment throughout occasions of financial instability. As conventional retirement accounts will be vulnerable to market downturns, the introduction of gold IRAs provides investors a solution to diversify their portfolios and protect their savings.

The technique of establishing a gold IRA is relatively simple. Buyers can roll over funds from an present retirement account, akin to a 401(ok) or conventional IRA, into a self-directed gold IRA. This allows them to buy bodily gold, silver, platinum, or palladium, which is then stored in a secure, IRS-accepted depository. It’s necessary to note that not all gold is eligible for inclusion in an IRA; the IRS has particular requirements regarding the purity and kind of metals that may be held in these accounts.

One in all the primary benefits of investing in gold by means of an IRA is the potential for tax advantages. Contributions to a conventional IRA may be tax-deductible, and the funding grows tax-deferred till withdrawal. Additionally, gold IRAs can be established as Roth IRAs, allowing for tax-free withdrawals in retirement. This dual profit makes gold an attractive option for lengthy-term financial savings.

The demand for gold has also been fueled by latest international occasions that have shaken investor confidence. The COVID-19 pandemic, for example, led to unprecedented economic turmoil, pushing many to hunt refuge in gold as a protected asset. As central banks all over the world carried out aggressive monetary insurance policies, including low interest rates and quantitative easing, the value of fiat currencies came beneath strain. In such an surroundings, gold’s attraction as a hedge towards inflation and forex devaluation has only intensified.

Furthermore, the geopolitical panorama has contributed to the rising curiosity in gold IRAs. Tensions between major world powers, trade disputes, and ongoing conflicts have led to increased market volatility. Investors are increasingly aware that gold can serve as a hedge against geopolitical risks, providing a way of stability in uncertain times.

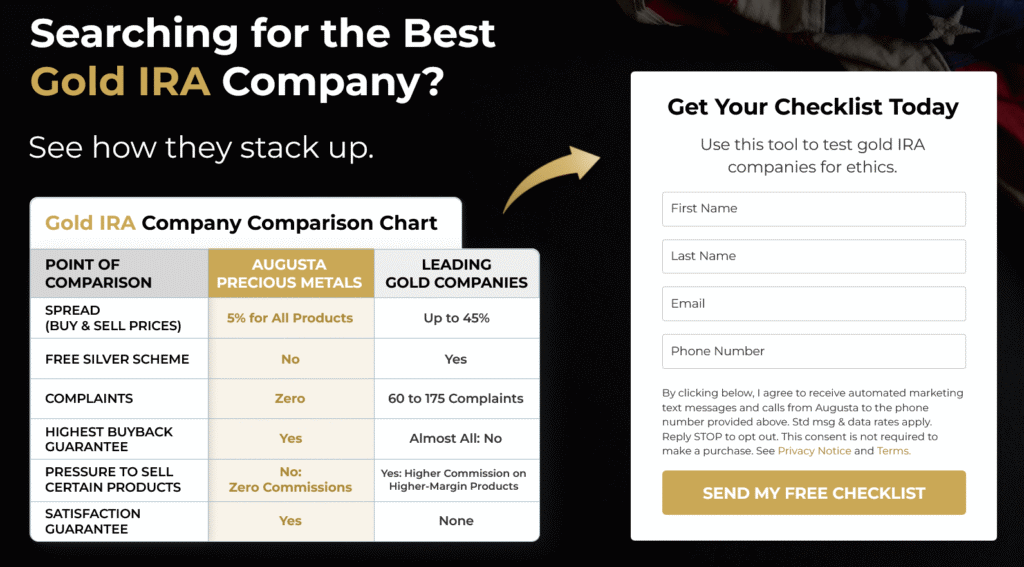

However, potential buyers should also remember of the challenges associated with gold IRAs. One of the primary issues is the price of storage and insurance coverage for the bodily gold. Not like traditional stocks or bonds, which might be simply bought and offered, gold requires safe storage, which regularly comes with extra fees. Investors must even be cautious about the potential for scams in the gold investment space, because the rise in reputation has attracted unscrupulous operators seeking to benefit from unsuspecting patrons.

Additionally, whereas gold has traditionally been a stable investment, it isn’t with out its risks. The price of gold could be unstable, influenced by various components, including provide and demand dynamics, interest charges, and global financial circumstances. Due to this fact, traders ought to method gold as a part of a diversified portfolio fairly than a standalone resolution.

The regulatory framework surrounding gold IRAs can also be an important consideration. The IRS has specific guidelines governing the sorts of gold and other treasured metals that may be included in these accounts. Traders should work with reputable custodians and dealers who’re knowledgeable about the rules to ensure compliance and keep away from potential penalties.

Despite these challenges, the rising interest in gold IRAs reflects a broader development toward different investments. If you have any sort of questions concerning where and exactly how to use Gold Ira said, you can contact us at our web-site. As more people search to take control of their financial futures, the attraction of tangible belongings like gold continues to rise. Financial advisors more and more advocate diversifying portfolios with a mixture of conventional and various investments, including valuable metals.

In conclusion, the rising popularity of IRA gold represents a shift in how buyers view retirement financial savings. As financial uncertainties persist, the demand for gold as a secure haven asset is prone to continue growing. By providing a mixture of tax benefits, safety in opposition to inflation, and a hedge towards geopolitical risks, gold IRAs present a compelling choice for those looking to safe their financial future. However, potential traders ought to conduct thorough analysis and consult with monetary professionals to navigate the complexities of this investment car effectively. With cautious planning and consideration, gold can play a worthwhile function in a properly-rounded retirement technique.

No listing found.